As the state reopens, it is important to remember that we all are responsible for continuing to protect ourselves and one another. The State of Oregon provided the following guidance to remind us how to move forward safely:

The Baker County Economic Development Director, the Baker City Manager, Baker County Chamber, and the Oregon Small Business Development Center have taken the lead in coordinating recovery efforts within Baker County. We are working in tandem with the Baker County Emergency Operations Center. As this crisis evolves, we will attempt to coordinate any aid that may be forthcoming from State, Federal and other entities.

Following is a list of a number of programs that are changing daily. We are attempting to keep this list as current as possible to assist Individuals. If you would like assistance in participating in any of these programs, please contact the Baker County Business and Recovery Task Force at 541-523-0015. If there is no answer or you have called after normal business hours, please leave a message and your call will be returned as soon as possible.

Paid Leave for Some Employees who need to Quarantine

A new program was started to help people who work in Oregon and need to quarantine or isolate due to COVID-19 exposure, but do not have access to COVID-19-related paid sick leave. Eligibility requirements can be found at the website listed below.

The COVID-19 Temporary Paid Leave Program was created with $30 million received from the federal government to help Oregon respond to the coronavirus pandemic. People who qualify will receive a $120 per-day payment for up to 10 working days ($1,200 total) for the time they are required to quarantine. Employees can apply online starting Wednesday, Sept. 16, at oregon.gov/covidpaidleave.

Economic Impact Payments

According to the Internal Revenue Service (IRS), Economic Impact Payments will be issued as soon as possible. Please read the IRS website, which provides guidance on whether you are eligible for these payments.

To check on the status of your Economic Impact Payment, please follow this link: https://www.irs.gov/coronavirus/get-my-payment.

Worksource Oregon

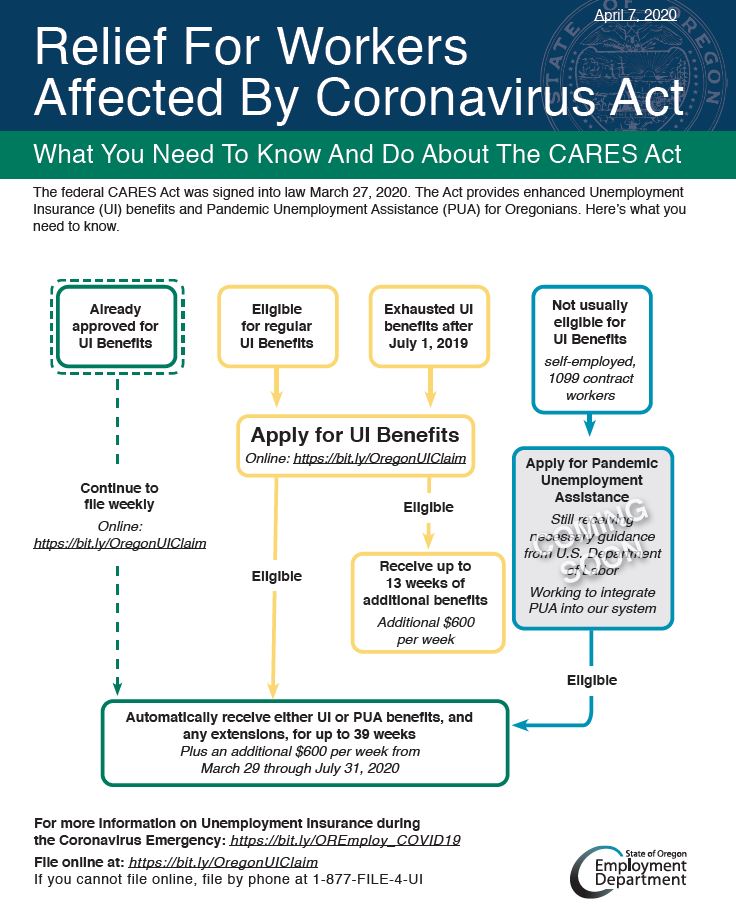

The State of Oregon Employment Department has released the following updates on Unemployment Insurance:

- What is the date when the extra $600 is effective? People began receiving their additional $600 per week payments this week. These payments are added to (but made via a separate payment) other unemployment insurance benefits people receive for the weeks of March 29 through July 25, 2020.

- When will self employed people be eligible, will $600 be back dated for these? People who are not eligible for regular unemployment insurance benefits, including self-employed people, can get benefits under the new federal Pandemic Unemployment Assistance program (PUA). PUA benefits are available for the time period February 2 through December 26, 2020. People receiving PUA benefits will also receive the additional $600 per week for the time period March 29 through July 25, 2020. We are still creating the PUA program in our systems. We will provide updates on how to apply on our website as soon as the application process is created. It will likely be several weeks before we are able to program this complex new benefits program into our legacy computer systems. Benefits will be able to be backdated to when a person first qualified for these new federal benefits.

The Employment Department is committed to the health and safety of our customers and the public and has created a COVID-19 Resource.

The Oregon Employment Department is working to ensure everyone has access to the most current guidance for employers, workers, and job seekers who may be impacted by the COVID-19 virus. Information continues to change daily, including where and how to apply for unemployment insurance benefits and eligibility requirements. Please visit the department’s COVID-19 employment-related web page for the latest information:

https://govstatus.egov.com/ORUnemployment_COVID19

As of March 24, 2020, the State of Oregon Employment Department offices are accepting visitors by appointment only in order to help slow the spread of COVID-19. Please contact your local WorkSource center at (541)523-6331 for job seeker and employer services. Phone and online service options are also available. Unemployment Insurance claims can only be filed using our online system or by calling 1-877-FILE-4-UI. We encourage everyone who can to file online and help keep wait times down on the phone.

On March 29, the CARES Act was signed into law, which will expand Unemployment Insurance benefits. We are working to incorporate these new changes into our resource guides, and will issue a news release and additional online announcements about pandemic unemployment assistance and unemployment benefit extensions as we receive guidance from the U.S. Department of Labor.

This video from the Oregon Employment Department focuses on filing a new claim application during the COVID-19 State of Emergency.

The Restaurant Employee Relief Fund was created to help restaurant industry employees experiencing hardship in the wake of the coronavirus disease (COVID-19) outbreak. Through this Fund, grants will be made to restaurant industry employees who have demonstrated being financially impacted by COVID-19, whether through a decrease in wages or loss of employment. These grants will be made on a first-come first-served basis, subject to availability of funds. 100% of the Fund’s proceeds will go to providing grants to restaurant workers. This Fund is operated by the National Restaurant Association Educational Foundation, whose mission is to attract, empower and advance today’s and tomorrow’s restaurant and foodservice workers.

Senator Merkely’s webpage includes FAQs about expanded unemployment benefits through the recently passed federal aid bills, and other resources, can be found here.

Congressman Walden’s webpage includes FAQs about legislation related to COVID-19, and can be found here.

Additional information from Senator Wyden about applying for unemployment assistance, can be found here.

March 2020 Archives:

WorkShare Oregon is a key program that helps you keep skilled employees during slow times by providing partial Unemployment Insurance benefits to supplement employees’ reduced hours.

Another resource for small businesses and employers planning and responding to the impacts of COVID-19 is the National Business Emergency Operations Center.